Investor Presentation Alan F. Joslyn, PhD President & CEO 813 286 7900 ext 232 ajoslyn@oragenics.com Oragenics, Inc. 4902 Eisenhower Blvd., Suite 125 Tampa, FL 33634 www.oragenics.com Filed pursuant to Rule 163 and 433 Registration Statement No. 333-224950 July 5, 2018

Safe Harbor Statement Certain statements made in this presentation include forward-looking actions that Oragenics, Inc. (“Oragenics,” or the “Company”) anticipates based on certain assumptions. These statements are indicated by words such as “expect”, “anticipate”, “should” and similar words indicating uncertainty in facts, figures and outcomes. Such statements are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. While Oragenics believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such statements will prove to be correct. The risks associated with the Company are detailed in the Company’s various reports filed by the Company with the Securities and Exchange Commission.

Free Writing Prospectus This presentation highlights basic information about us and the offering. Because it is a summary that has been prepared solely for informational purposes, it does not contain all of the information that you should consider before investing in our company. Except as otherwise indicated, this presentation speaks only as of the date hereof This presentation does not constitute an offer to sell, nor a solicitation of an offer to buy, any securities by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. Neither the Securities and Exchange Commission (the “SEC”) nor any other regulatory body has approved or disapproved of our securities or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. This presentation includes industry and market data that we obtained from industry publications and journals, third-party studies and surveys, internal company studies and surveys, and other publicly available information. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions that were used in preparing the forecasts from the sources relied upon or cited herein. We have filed a Registration Statement on Form S-1 with the SEC, May 15, 2018 and an amended Form S-1/A including a preliminary prospectus dated July 5, 2018 (the “Preliminary Prospectus”) with respect to the offering of our securities to which this communication relates. Before you invest, you should read the Preliminary Prospectus (including the risk factors described therein) and, when available, the final prospectus relating to the offering, and the other documents filed with the SEC and incorporated by reference into the Preliminary Prospectus, for more complete information about us and the offering. You may obtain these documents, including the Preliminary Prospectus, for free by visiting EDGAR on the SEC website at http://sec.gov. Alternatively, we or any underwriter participating in the offering will arrange to send you the prospectus if you request it by contacting Ladenburg Thalmann & Co. Inc., 277 Park Avenue, 26th Floor, New York, NY 10172 or by email at prospectus@ladenburg.com.

Risk Factors Investing in our securities involves a high degree of risk. You should consider the following risk factors, as well as other risk factors stated in our public filings including 10K and 10Q. These factors include but are not limited to: We will need to raise additional capital in the future to complete the development and commercialization of our product candidates and operate our business. If we are unable to successfully develop our product candidates, our operating results and competitive position could be harmed. The further development and ultimate commercialization of product candidates for lantibiotics and oral mucositis are keys to our growth strategy. We do not have any product revenue since we sold our consumer probiotics business in June of 2016. Our exclusive channel collaboration agreements with Intrexon and its wholly owned subsidiaries are based on early stage technologies in their fields. We will incur additional expenses in connection with our exclusive channel collaboration agreements with Intrexon. We may not be able to retain the exclusive rights licensed to us by Intrexon to develop and commercialize lantibiotic products and AG013 related products. If any of our product candidates are shown to be ineffective or harmful in humans, we will be unable to generate revenues from these product candidates.

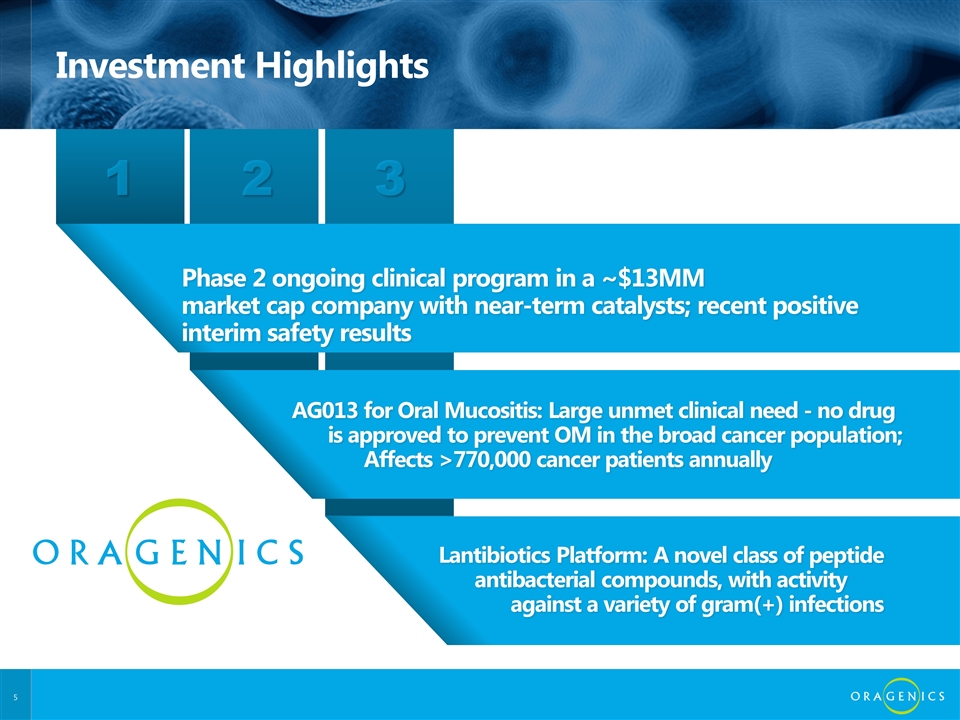

Investment Highlights Phase 2 ongoing clinical program in a ~$13MM market cap company with near-term catalysts; recent positive interim safety results AG013 for Oral Mucositis: Large unmet clinical need - no drug is approved to prevent OM in the broad cancer population; Affects >770,000 cancer patients annually Lantibiotics Platform: A novel class of peptide antibacterial compounds, with activity against a variety of gram(+) infections 1 2 3

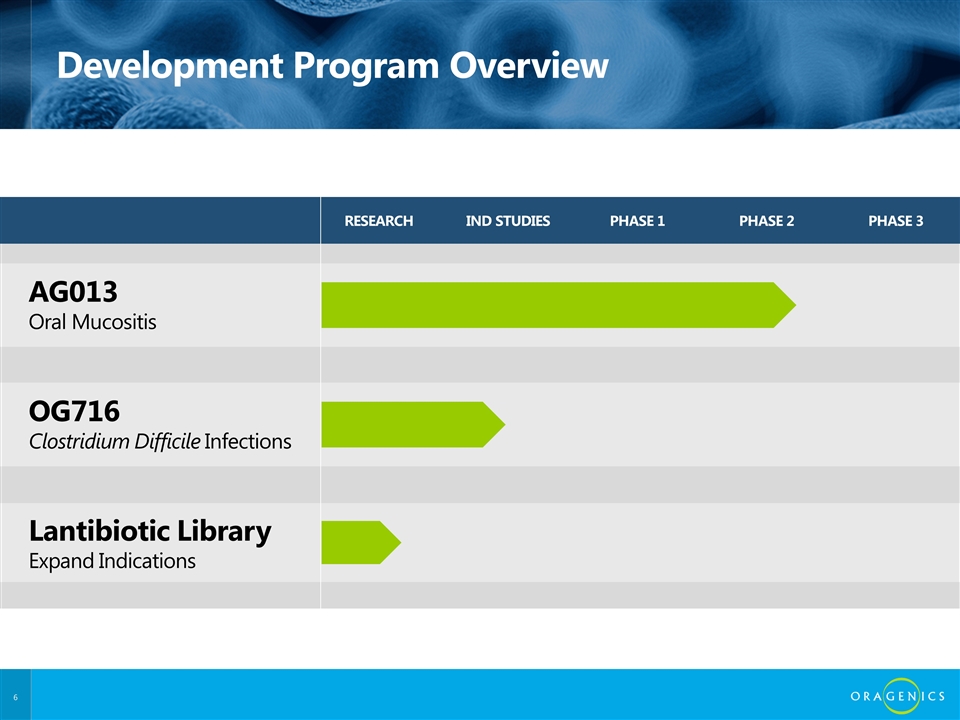

RESEARCH IND STUDIES PHASE 1 PHASE 2 PHASE 3 AG013 Oral Mucositis OG716 Clostridium Difficile Infections Lantibiotic Library Expand Indications Development Program Overview

AG013: First-in-Class Therapy for Oral Mucositis

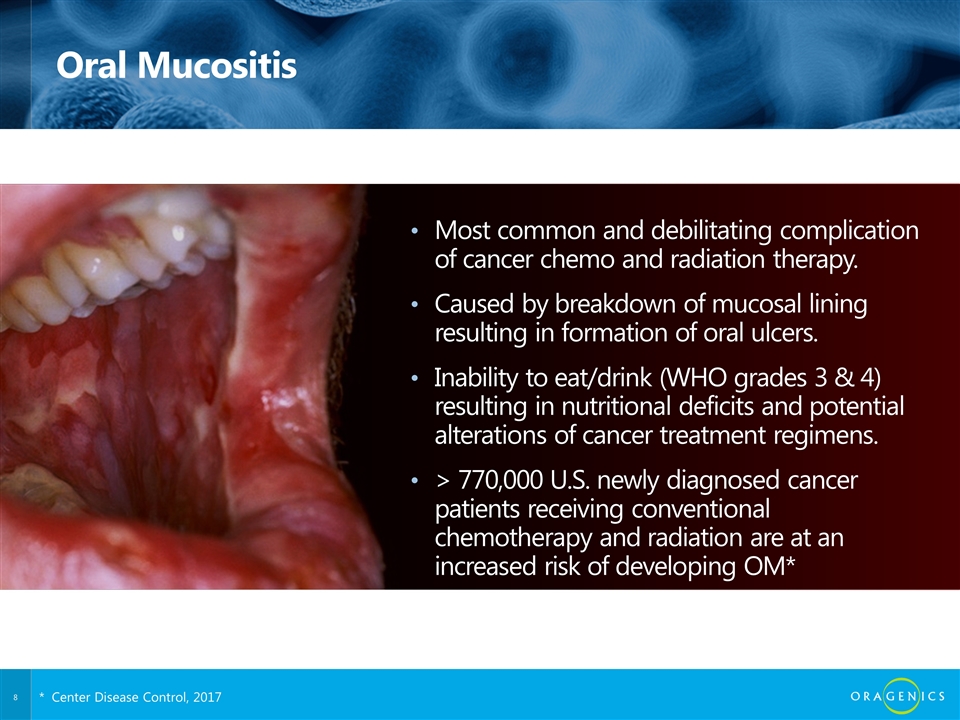

Oral Mucositis Most common and debilitating complication of cancer chemo and radiation therapy. Caused by breakdown of mucosal lining resulting in formation of oral ulcers. Inability to eat/drink (WHO grades 3 & 4) resulting in nutritional deficits and potential alterations of cancer treatment regimens. > 770,000 U.S. newly diagnosed cancer patients receiving conventional chemotherapy and radiation are at an increased risk of developing OM* * Center Disease Control, 2017

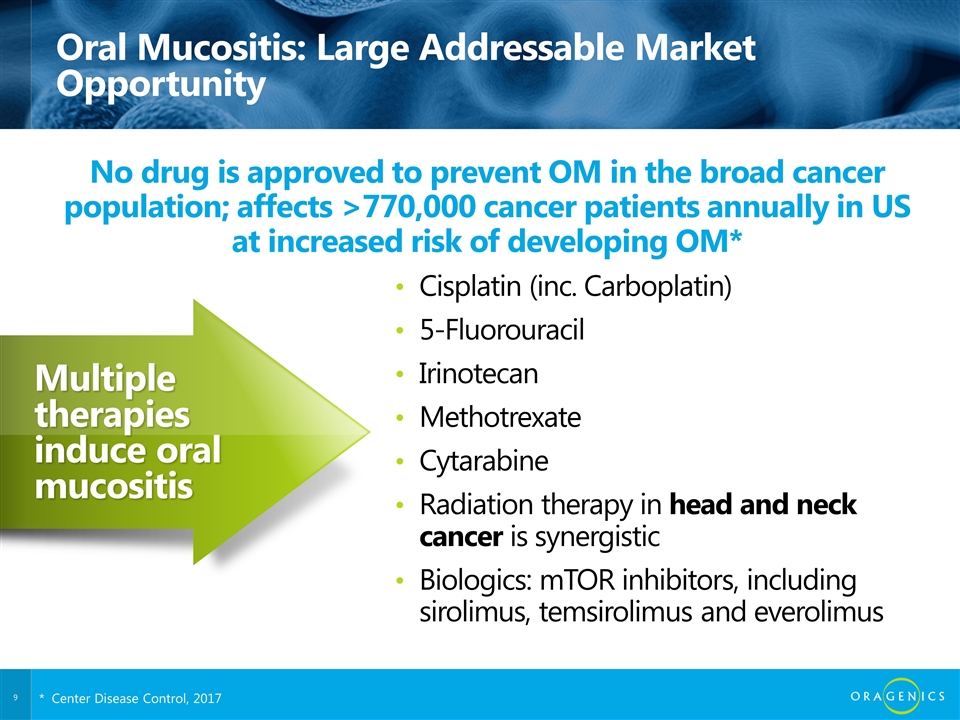

Oral Mucositis: Large Addressable Market Opportunity Cisplatin (inc. Carboplatin) 5-Fluorouracil Irinotecan Methotrexate Cytarabine Radiation therapy in head and neck cancer is synergistic Biologics: mTOR inhibitors, including sirolimus, temsirolimus and everolimus No drug is approved to prevent OM in the broad cancer population; affects >770,000 cancer patients annually in US at increased risk of developing OM* Multiple therapies induce oral mucositis 8 * Center Disease Control, 2017

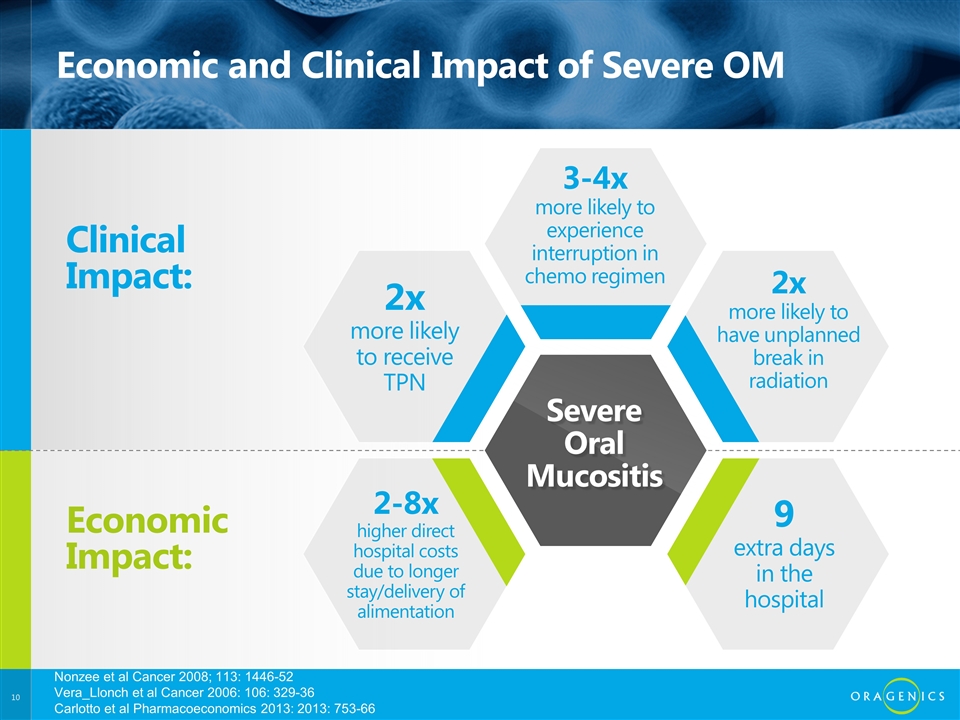

Economic and Clinical Impact of Severe OM Clinical Impact: Economic Impact: 2x more likely to receive TPN 3-4x more likely to experience interruption in chemo regimen 2x more likely to have unplanned break in radiation 9 extra days in the hospital 2-8x higher direct hospital costs due to longer stay/delivery of alimentation Severe Oral Mucositis Nonzee et al Cancer 2008; 113: 1446-52 Vera_Llonch et al Cancer 2006: 106: 329-36 Carlotto et al Pharmacoeconomics 2013: 2013: 753-66

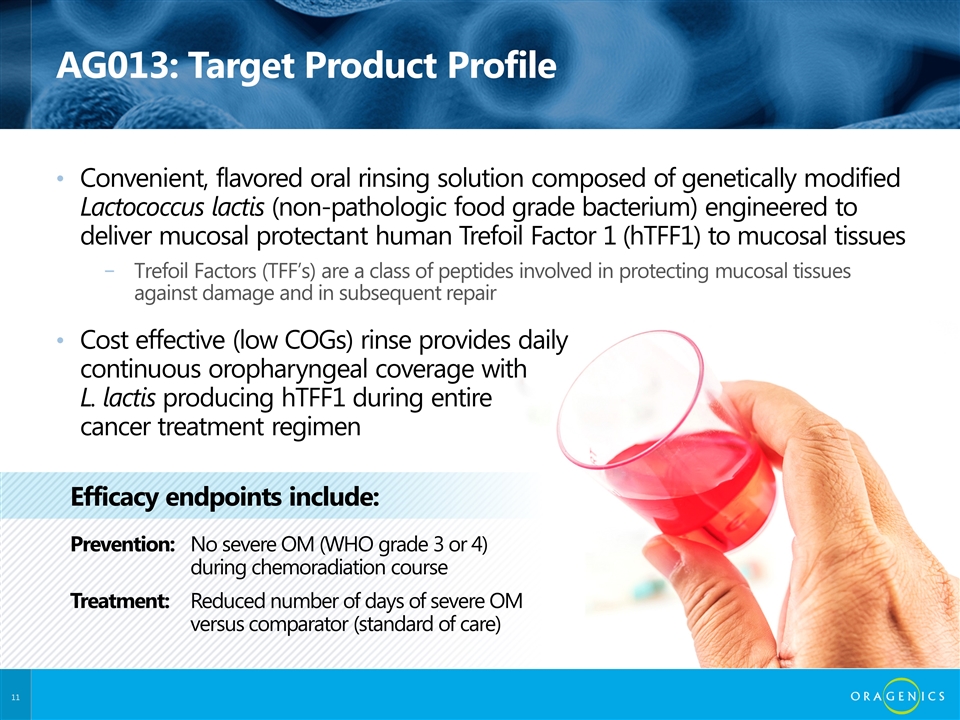

AG013: Target Product Profile Convenient, flavored oral rinsing solution composed of genetically modified Lactococcus lactis (non-pathologic food grade bacterium) engineered to deliver mucosal protectant human Trefoil Factor 1 (hTFF1) to mucosal tissues Trefoil Factors (TFF’s) are a class of peptides involved in protecting mucosal tissues against damage and in subsequent repair Cost effective (low COGs) rinse provides daily continuous oropharyngeal coverage with L. lactis producing hTFF1 during entire cancer treatment regimen Efficacy endpoints include: Prevention:No severe OM (WHO grade 3 or 4) during chemoradiation course Treatment:Reduced number of days of severe OM versus comparator (standard of care)

AG013 in Action AG013 is delivered via lactococcus The combination is freeze-dried into vials Patient mixes powder with a raspberry-flavored solution Patient swishes for 30 seconds after every meal This activity promotes a protein called trefoil factor, which regrows the oral lining 1 2 3 4 5

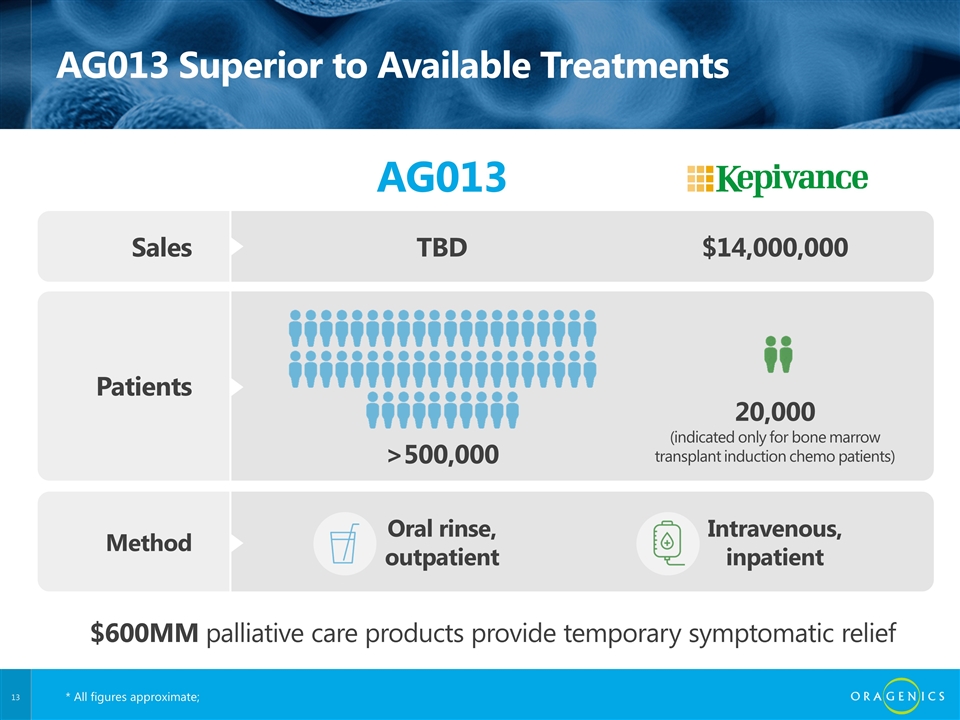

AG013 Superior to Available Treatments AG013 Sales TBD $14,000,000 Patients >500,000 20,000 (indicated only for bone marrow transplant induction chemo patients) Method Oral rinse, outpatient Intravenous, inpatient $600MM palliative care products provide temporary symptomatic relief * All figures approximate;

Potential Global Market: 6.2 MILLION+ new patients ww/yr (1.2MM develop OM) Cost: $100 per day 20- 25% Peak Share: AG013 Has Potential for Global Peak Sales to be a $2.2B for Oral Mucositis Peak Sales: $635M $458M $229M U.S. E.U. Japan Gross Margin: 90% Intellectual property relating to AG013 extends into 2030s REVENUE-BASED FORECAST ASSUMPTIONS

AG013: Established Regulatory Path Backdrop: No approved drug to prevent oral mucositis in broad cancer population and current therapies are primarily palliative creates favorable regulatory environment. Received FDA Fast Track designation in November 2016 Frequent program interactions Shorter NDA review times Potential for phase 2 study to be considered one of two pivotal trials Granted Orphan Drug status in EU

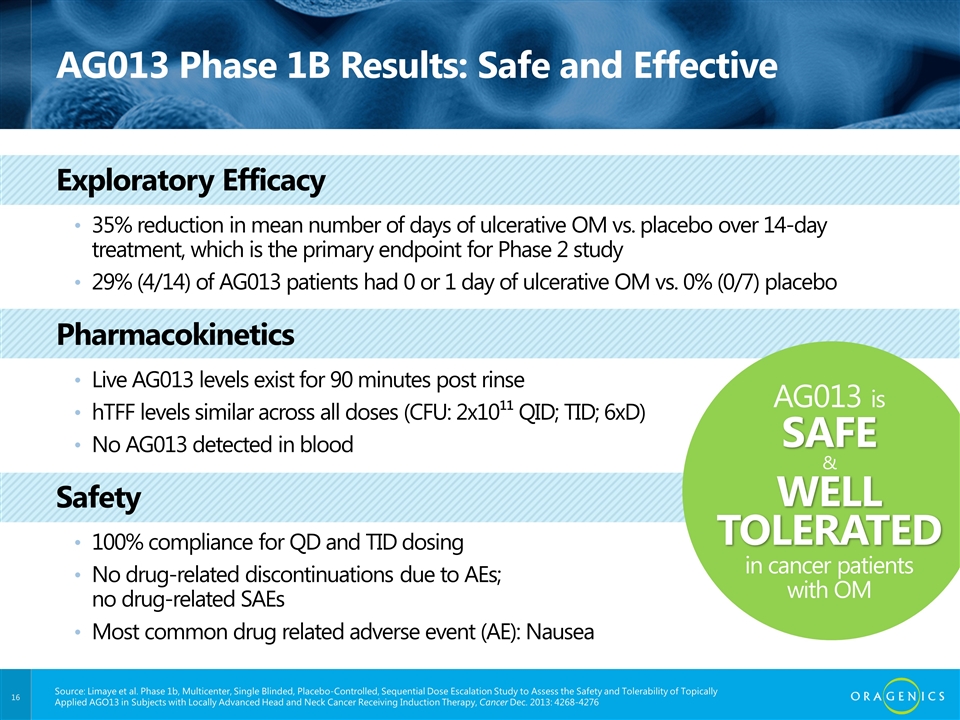

AG013 Phase 1B Results: Safe and Effective Exploratory Efficacy 35% reduction in mean number of days of ulcerative OM vs. placebo over 14-day treatment, which is the primary endpoint for Phase 2 study 29% (4/14) of AG013 patients had 0 or 1 day of ulcerative OM vs. 0% (0/7) placebo Pharmacokinetics Live AG013 levels exist for 90 minutes post rinse hTFF levels similar across all doses (CFU: 2x10¹¹ QID; TID; 6xD) No AG013 detected in blood Safety 100% compliance for QD and TID dosing No drug-related discontinuations due to AEs; no drug-related SAEs Most common drug related adverse event (AE): Nausea Source: Limaye et al. Phase 1b, Multicenter, Single Blinded, Placebo-Controlled, Sequential Dose Escalation Study to Assess the Safety and Tolerability of Topically Applied AGO13 in Subjects with Locally Advanced Head and Neck Cancer Receiving Induction Therapy, Cancer Dec. 2013: 4268-4276 AG013 is SAFE & WELL TOLERATED in cancer patients with OM

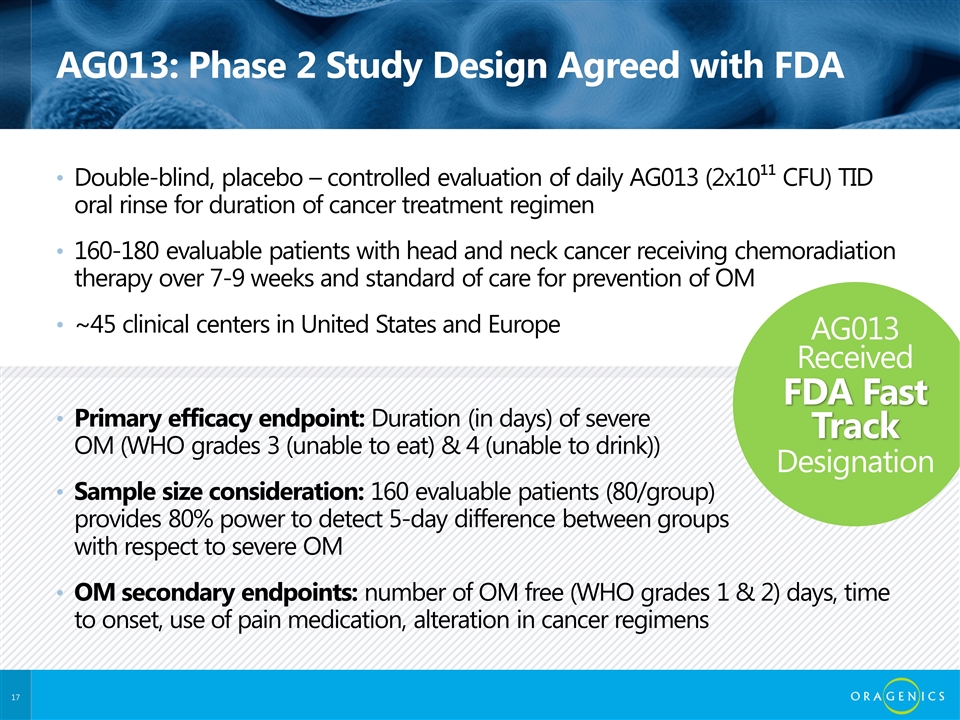

AG013: Phase 2 Study Design Agreed with FDA Double-blind, placebo – controlled evaluation of daily AG013 (2x10¹¹ CFU) TID oral rinse for duration of cancer treatment regimen 160-180 evaluable patients with head and neck cancer receiving chemoradiation therapy over 7-9 weeks and standard of care for prevention of OM ~45 clinical centers in United States and Europe Primary efficacy endpoint: Duration (in days) of severe OM (WHO grades 3 (unable to eat) & 4 (unable to drink)) Sample size consideration: 160 evaluable patients (80/group) provides 80% power to detect 5-day difference between groups with respect to severe OM OM secondary endpoints: number of OM free (WHO grades 1 & 2) days, time to onset, use of pain medication, alteration in cancer regimens AG013 Received FDA Fast Track Designation

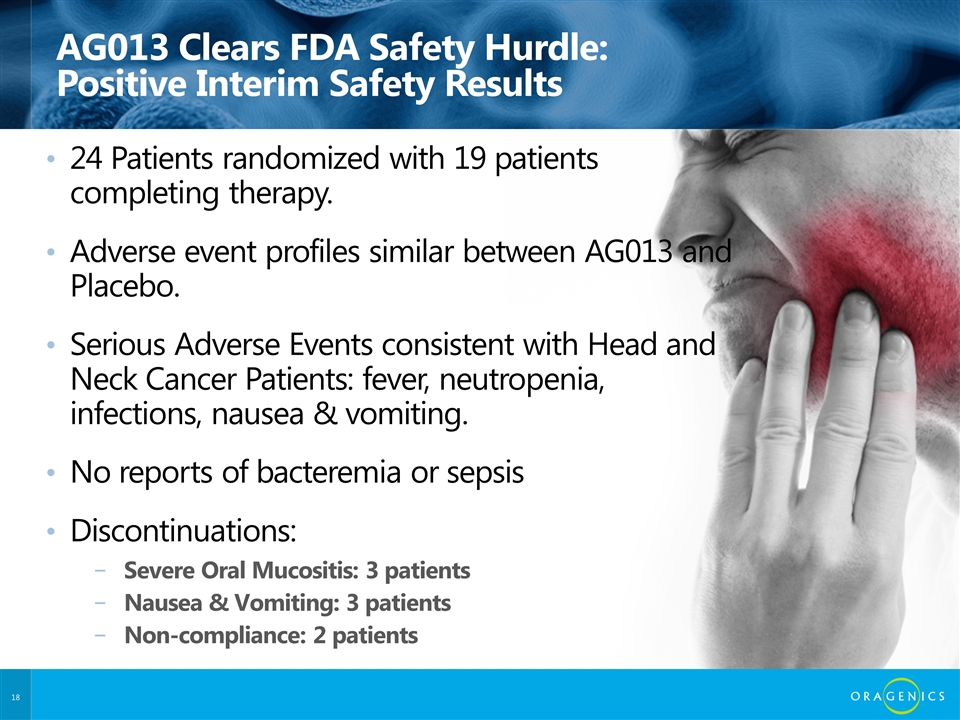

AG013 Clears FDA Safety Hurdle: Positive Interim Safety Results 24 Patients randomized with 19 patients completing therapy. Adverse event profiles similar between AG013 and Placebo. Serious Adverse Events consistent with Head and Neck Cancer Patients: fever, neutropenia, infections, nausea & vomiting. No reports of bacteremia or sepsis Discontinuations: Severe Oral Mucositis: 3 patients Nausea & Vomiting: 3 patients Non-compliance: 2 patients

AG013: Timeline of Key Events FDA Program Feedback API Manufacture & Packaging Completion Treat First Patient in U.S. Complete Enrollment of ~200 patients Interim Safety & Efficacy Review of First 20 Patients Update IND Filing ● ● ● ● ● ● Protocol design & manufacturing specifications agreement Activated 11 U.S. clinical sites 3Q16 2Q17 3Q17 2Q19 2Q18 3Q17

Novel Lantibiotic Platform for Multidrug Resistant Bacterial Infections

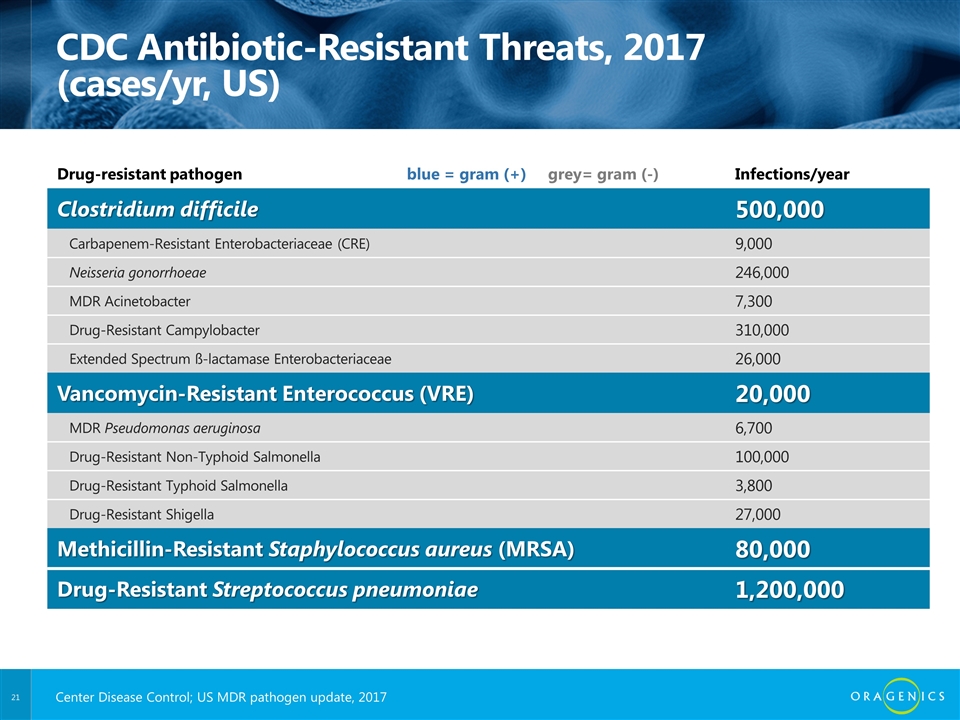

CDC Antibiotic-Resistant Threats, 2017 (cases/yr, US) Drug-resistant pathogen blue = gram (+) grey= gram (-) Infections/year Clostridium difficile 500,000 Carbapenem-Resistant Enterobacteriaceae (CRE) 9,000 Neisseria gonorrhoeae 246,000 MDR Acinetobacter 7,300 Drug-Resistant Campylobacter 310,000 Extended Spectrum ß-lactamase Enterobacteriaceae 26,000 Vancomycin-Resistant Enterococcus (VRE) 20,000 MDR Pseudomonas aeruginosa 6,700 Drug-Resistant Non-Typhoid Salmonella 100,000 Drug-Resistant Typhoid Salmonella 3,800 Drug-Resistant Shigella 27,000 Methicillin-Resistant Staphylococcus aureus (MRSA) 80,000 Drug-Resistant Streptococcus pneumoniae 1,200,000 Center Disease Control; US MDR pathogen update, 2017

C. difficile and C. difficile Infection (CDI): Epidemiology C. difficile is an infection of the colon causing colitis by producing toxins that damage lining of the colon 500,000 infections annually resulting in 29,000 deaths 83,000 will experience at least one recurrence Deaths have increased 400% since 2000 Healthcare-associated infections occur: 37% hospital onset, 36% nursing home onset, 27% community onset C. difficile associated diarrhea is associated with a 1-2 week hospital stay Emerging problem: 8% of CDI associated with onset of concomitant Vancomycin Resistant Enterococci (VRE) infection

Competitive Overview Currently Approved Therapies: Metronidazole Vancomycin Fidaxomicin Rifaximin Zinplava (monoclonal antibody) Therapies under development: Follow-on generations of existing antibiotics, enzymes and enzyme/protein synthesis inhibitors, vaccines, microbiome/fecal transplant therapies, and toxin binding polyclonal antibodies. * Source: GlobalData Projected 2019 U.S. sales for C. difficile therapies: $426M*

Lantibiotics: Novel Platform of Antibiotics to Treat Serious Life-Threatening Infections Lantibiotics are novel class of peptide antibacterial compounds naturally produced by variety of Gram-positive bacterial strains to attack competing bacterial strains Platform: >700 lantibiotic structures created, potentially generating a pipeline of new compounds Prior development limited by manufacturing technical hurdles Platform provides potential for development in multidrug resistant infections: Methicillin Resistant Staphlococcus aureus (MRSA) Vancomycin Resistant Enterococci (VRE) Virulent Clostridium difficile Gram(-) infections Mutacin 1140: a lantibiotic produced by Streptococcus mutans

Lantibiotic Profile Preliminary MU1140 (parent compound) preclinical data: Novel mechanism of action (unique binding to Lipid II) No cross-reactivity with existing classes of antibiotics Minimal in vitro cytotoxicity in mouse and human cell lines; minimal immunogenicity OG716 selected as lead compound for treatment of C. difficile infections Orally active Microbiology profile favorably compares to previous compounds Potent against Clostridium difficile in standard animal infection model Intellectual property extends into late 2030s for second-generation compounds

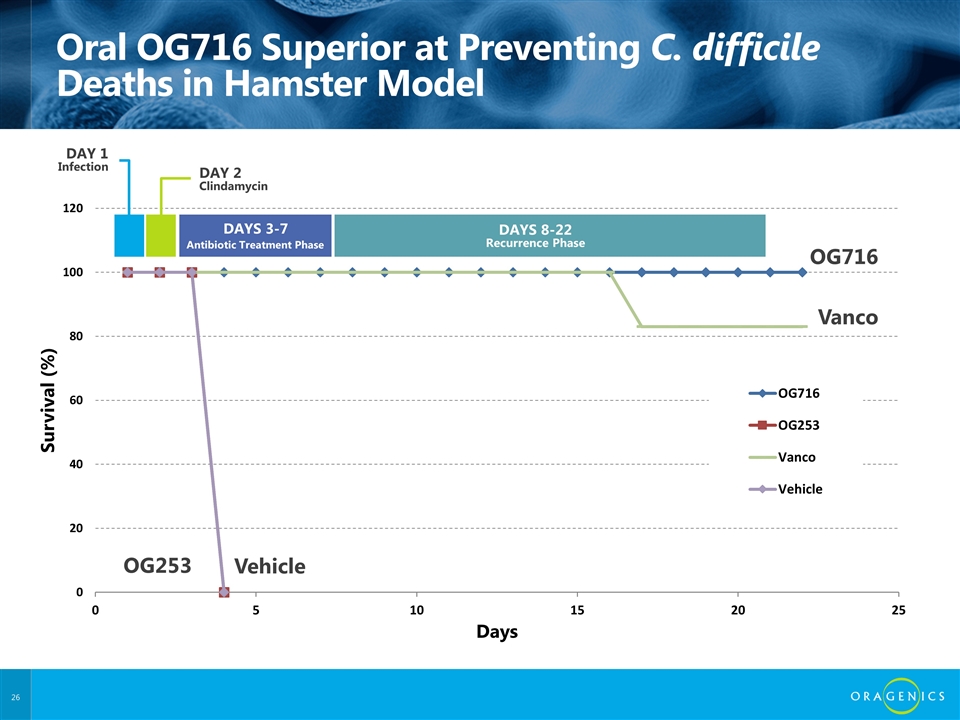

Oral OG716 Superior at Preventing C. difficile Deaths in Hamster Model OG716 Vanco Vehicle OG253 DAY 2 Clindamycin DAYS 3-7 DAYS 8-22 Recurrence Phase DAY 1 Infection Antibiotic Treatment Phase

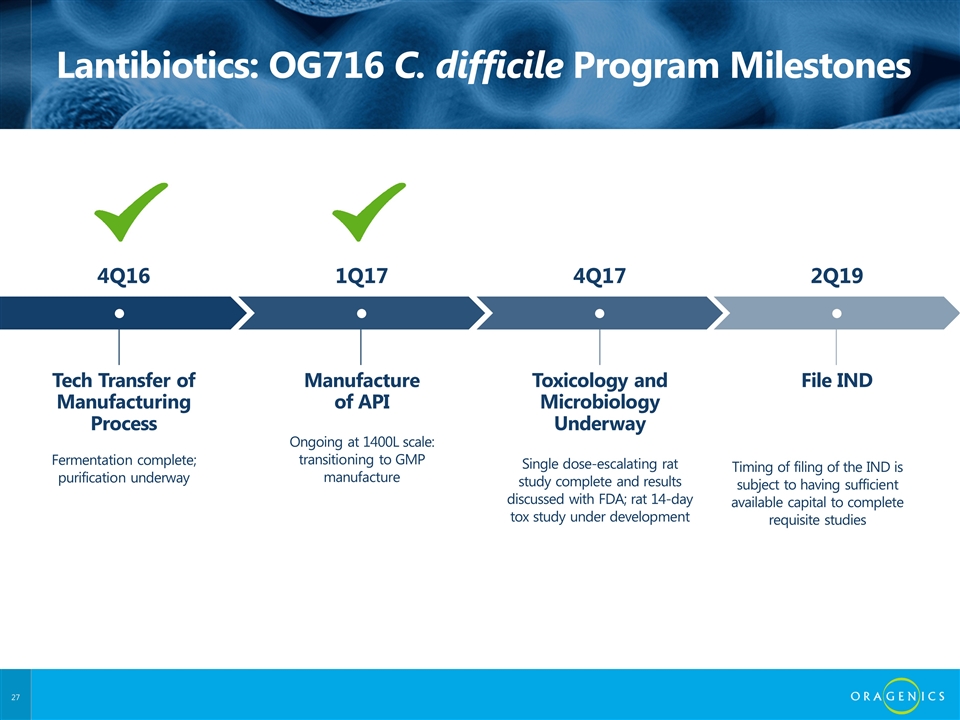

Lantibiotics: OG716 C. difficile Program Milestones Tech Transfer of Manufacturing Process ● Fermentation complete; purification underway 4Q16 Manufacture of API ● Ongoing at 1400L scale: transitioning to GMP manufacture 1Q17 Toxicology and Microbiology Underway ● Single dose-escalating rat study complete and results discussed with FDA; rat 14-day tox study under development 4Q17 File IND ● 2Q19 Timing of filing of the IND is subject to having sufficient available capital to complete requisite studies

Corporate Status Update

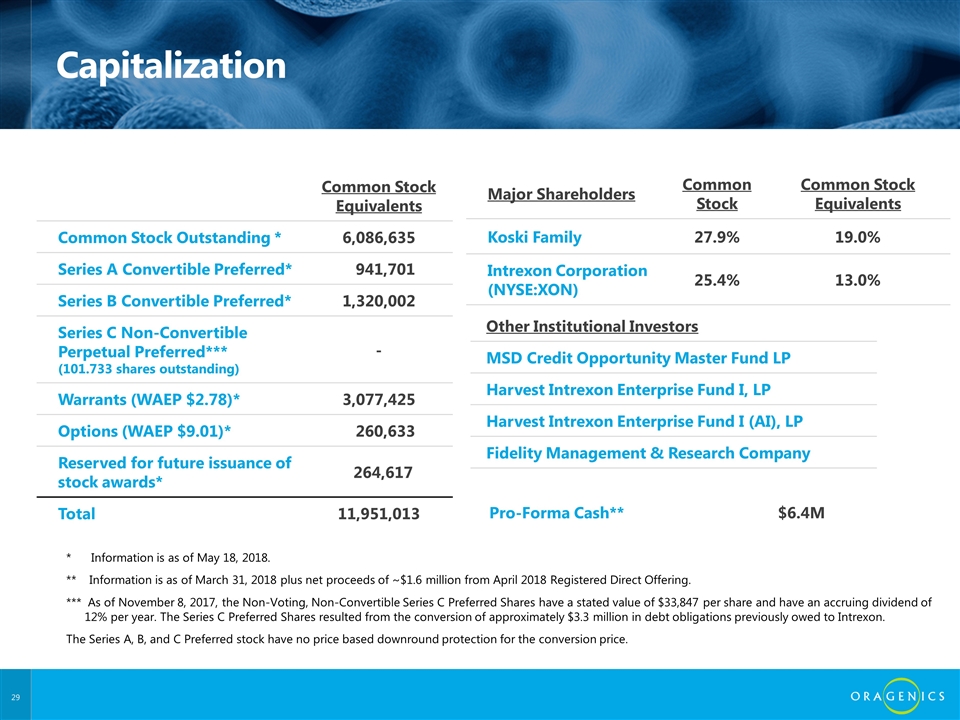

Capitalization Common Stock Equivalents Common Stock Outstanding * 6,086,635 Series A Convertible Preferred* 941,701 Series B Convertible Preferred* 1,320,002 Series C Non-Convertible Perpetual Preferred*** (101.733 shares outstanding) - Warrants (WAEP $2.78)* 3,077,425 Options (WAEP $9.01)* 260,633 Reserved for future issuance of stock awards* 264,617 Total 11,951,013 Major Shareholders Common Stock Common Stock Equivalents Koski Family 27.9% 19.0% Intrexon Corporation (NYSE:XON) 25.4% 13.0% Pro-Forma Cash** $6.4M * Information is as of May 18, 2018. ** Information is as of March 31, 2018 plus net proceeds of ~$1.6 million from April 2018 Registered Direct Offering. *** As of November 8, 2017, the Non-Voting, Non-Convertible Series C Preferred Shares have a stated value of $33,847 per share and have an accruing dividend of 12% per year. The Series C Preferred Shares resulted from the conversion of approximately $3.3 million in debt obligations previously owed to Intrexon. The Series A, B, and C Preferred stock have no price based downround protection for the conversion price. Other Institutional Investors MSD Credit Opportunity Master Fund LP Harvest Intrexon Enterprise Fund I, LP Harvest Intrexon Enterprise Fund I (AI), LP Fidelity Management & Research Company

Experienced Management Team Dr. Alan F. Joslyn Director, President and Chief Executive Officer Assumed CEO position at Oragenics in June 2016 Held CEO positions at several private biotechnology companies including Sentinella Pharmaceuticals, Edusa Pharmaceuticals and Mt. Cook Pharma Presently sits on the board of Synergy Pharmaceuticals (NASDAQ: SGYP) Over 25 years of drug development experience at Glaxo, Johnson & Johnson and Penwest Mike Sullivan Chief Financial Officer Held senior-level financial positions for both publicly and privately held businesses Significant experience in product licensing and IP issues with strong background in both domestic and international retail operations Dr. Martin Handfield Senior Vice President, Discovery Research Molecular Microbiologist and former Tenured Associate Professor, College of Dentistry at The University of Florida Prolific researcher focusing on infectious diseases, host-pathogen interactions and non-invasive diagnostics