UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934.

Date

of Report:

(Date of earliest event reported)

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS.

As previously reported, we entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Odyssey Health, Inc., f/k/a Odyssey Group International, Inc., a Nevada corporation (“Odyssey”) and on December 28, 2023, we successfully closed the Odyssey Purchase Agreement. At such time, we purchased and assumed, and Odyssey sold and assigned, all assets (and assumed certain liabilities) related to the segment of Odyssey’s business focused on developing medical products that treat brain related illnesses and diseases (the “Neurology Assets”). The Neurology Assets include drug candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating Niemann Pick Disease Type C (NPC), as well as Odyssey’s proprietary powder formulation and its nasal delivery device. We are filing the Form 8-K to provide additional information about the Neurology Assets and its expected impact on our business.

As a result of the acquisition of the Neurology Assets, we expect that, in the near- and mid-terms, we will focus our resources and efforts on the continued development of the Neurology Assets and primarily ONP-002, which, as discussed further below, has successfully completed phase 1 clinical trials. The acquisition is expected to build on our expertise in intranasal platforms and expand our portfolio into more areas of unmet medical needs. Nasal delivery offers many advantages over standard systemic delivery systems, such as its non-invasive character, a fast onset of action and in many cases reduced side effects due to a more targeted delivery. We will concurrently determine how best to proceed with the development of our nasal COVID-19 product candidate, given our limited resources, and for the time being, we anticipate placing our lantibiotics program on hold.

In conjunction with the Neurology Asset acquisition, we paid Odyssey a total of $1,000,000 in cash, $500,000 of which was paid in October, 2023 and $500,000 of which was paid on December 11, 2023. In addition, at the closing, we issued Odyssey 8,000,000 shares of our newly created Series F Non-Voting Convertible Preferred Stock, which are convertible into our common stock on a one-to-one basis (subject to certain adjustments). Odyssey converted 511,308 of those shares into our common stock on December 28, 2023. Our Certificate of Designation creating the Series F Preferred Stock, specifies that the remainder of the shares are not convertible until the occurrence of all of the following: (i) Oragenics’ shall have applied for and been approved for initial listing on the NYSE American or another national securities exchange or shall have been delisted from the NYSE American, which Oragenics’ does not anticipate undertaking until it meets the NYSE American’s initial listing standards, and (ii) if required by the rules of the NYSE American, Oragenics’ shareholders shall have approved any change of control that could be deemed to occur upon the conversion of the Series F Preferred Stock into common stock, based on the fact and circumstances existing at such time.

Upon the closing of the Neurology Asset acquisition, Michael Redmond, who has served as President and CEO of Odyssey since 2018, was named President of Oragenics. Mr. Redmond has 35 years of commercial experience with medical device companies, having held various sales and marketing leadership positions that helped accelerate growth at companies to multiples of their previous revenue and valuation. Mr. Redmond also has significant experience in raising capital and securing licensing and distribution deals with major biotech and pharmaceutical companies. In his new position, it is expected Mr. Redmond will oversee the growth of Oragenics’ neurology product pipeline and intranasal drug delivery technologies. Additionally, it is expected the Odyssey management and development team that led the ONP-002 clinical trial design and implementation for the treatment of concussion, will continue to oversee research and development of the newly acquired Neurology Assets at Oragenics. The team has experience in conducting clinical trials, developing drug formulations and commercializing pharmaceutical products across a broad range of indications.

About Mild Traumatic Brain Injury (mTBI)

Concussions are an unmet medical need that affects millions worldwide. Repetitive concussions can increase the risk of developing chronic traumatic encephalopathy and other neuropsychiatric disorders. It is estimated there is upwards of 3.8M million sports-related concussions alone in the U.S. annually and that up to 50% go unreported (Hallock et al., 2023). The worldwide incidence is estimated at 69 million per year (Dewan et al., 2018). The global market for concussion treatment was valued at $6.9 billion in 2020 and is forecast to reach $8.9 billion by 2027, according to Grandview Research. Common settings for concussion include contact sports, military training and operations, motor vehicle accidents, children at play and elderly assistive-living facilities due to falls.

| 2 |

About ONP-002

The Neurology Assets acquired from Odyssey include ONP-002 and a unique nasal delivery device, Odyssey’s lead concussion assets, believed to be a first-in-class intranasal drug under development for the treatment of moderate-to-severe concussion in the acute through subacute phases (mTBI (concussion)).

ONP-002 is a fully synthetic, non-naturally occurring neurosteroid, is lipophilic, and can cross the blood-brain barrier to rapidly eliminate swelling, oxidative stress and inflammation while restoring proper blood flow through gene amplification.

ONP-002 to date has been shown to be stable up to 104 degrees for 18-months. The drug candidate is spray-dry manufactured into a powder and filled into the novel intranasal device. The drug is then administered through the nasal passage from the device. The novel intranasal device is lightweight and easy to use in the field.

The proprietary powder formulation and intranasal administration allows for rapid and direct accessibility to the brain. The device is breath propelled and Oragenics expects it to allow patients to blow into the device which closes the soft palate in the back of the nasopharynx, preventing the flow of drug to the lungs or esophagus, minimizes system exposure and side effects, and easily crosses the blood brain barrier. This mechanism traps ONP-002 in the nasal cavity allowing for more abundant and faster drug availability in the traumatized brain.

Expected ONP-002 Product Development Timeline:

| Pre-clinical Animal Studies | Phase 1 | Phase 2a | Phase 2b | Phase 3 | ||||

| Complete | Complete | Estimated May 2024 start | Estimated November 2024 start | Estimated November 2026 start |

This product development plan is an estimate and is subject to change based on funding, technical risks and regulatory approvals.

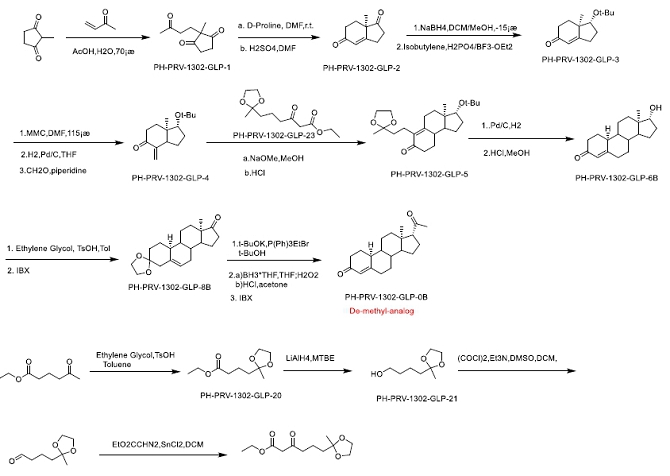

ONP-002 Structure and Synthesis. Pharmaron, Inc. is our current partner in the development of synthetic chemistry and manufacturing of the ONP-002 (Molecular Formula: C20H28O2, Molecular Weight: 300.14 g/mol). ONP-002 is the enantiomer (mirror image) of 19-Norprogesterone, a novel chemical entity based on its chiral purity and optical rotation. There are two components to this synthesis. The synthesis of PH-PRV-1302-GLP-23 (in blue) and the synthesis making use of PH-PRV-1302-GLP-23 to append the side chain necessary in ONP-002 production. ONP-002 is red in Figure 1 and defined as the De-methyl- analog. The current API was made under GMP standards.

| 3 |

Figure 1

Validation and Stability of ONP-002. Pharmaron issued a Certificate of Analysis (CoA, Appendix A-1). Testing methods were standard and include appearance, identification by 1H NMR, identification by Mass Spectroscopy (MS), optical purity by HPLC, residual solvent analysis, elemental impurities, percent water, and residue on ignition. Pharmaron has shown both the specifications and the results, indicating that the material supplied passes all criteria. ONP-002 is supplied by Pharmaron in pure form. As such, no excipients are present. Stability studies were performed by storing samples under carefully controlled conditions with respect to temperature and humidity. Pharmaron’s stability testing protocol included storage at 25 °C± 2 °C at 60% relative humidity ± 5% relative humidity for 24 months and 40 °C± 2 °C at 75% relative humidity ± 5% for 18 months (Appendix A-2). Samples are pulled at the scheduled time and analyzed for appearance, purity, assay, optical purity, and water content. No changes in ONP-002 were seen.

Formulation. The ONP-002 drug product formulation contains the active drug substance, ent-19-Norprogesterone with hydroxypropyl beta cyclodextrin (HPβCD) creating nanoparticles. Formulation of the product is achieved through solubilization of ONP-002 with HPβCD followed by spray drying and packaging into a breath-propelled intranasal delivery device. The spray-dried powder provides for a particle size between 11 and 12 microns upon dispersion from the device. For placebo dosing, the breath-propelled intranasal delivery device is pre-packaged with HPβCD only with no ONP-002 active drug substance. The highest achieved concentration of ONP-002 per dose is currently at 8% or 8mg/100mg given each intranasal dose is designed to deliver 100mg of the spray-dried formula. Studies have been designed to improve the final % of API as high as 32%.

Intellectual Property. Patents on ONP-002 have been filed and/or issued and a patent has been filed on the nasal delivery device as follows:

| ● | New chemical entity IP filing– USPTO pending, approved Europe and Canada |

| ○ | C-20 steroid compounds, composition and uses thereof to treat traumatic brain injury (TBI), including concussion. | |

| ○ | The invention relates to ONP-002 composition and methods of use thereof to treat, minimize and/or prevent traumatic brain injury (TBI), including severe TBI, moderate TBI, and mild TBI, including concussions. | |

| ○ | Patent expiration with max patent term extension – 9/17/2040 | |

| ○ | Patent expiration with no patent term extension – 9/17/2035 |

| ● | Method of intranasal delivery and device components – USPTO pending |

ONP-002 Pre-Clinical Trials

The drug has completed toxicology studies in rats and dogs. Studies show that ONP-002 has a safety margin over 90X its predicted efficacious dose. In preclinical animal studies, the asset demonstrated rapid and broad biodistribution throughout the brain while simultaneously reducing swelling, inflammation and oxidative stress, along with an excellent safety profile.

Results from the preclinical studies suggest that ONP-002 has an equivalent, and potentially superior, neuroprotective effect compared to related neurosteroids. The animals treated with the drug post-concussion showed positive behavioral outcomes using various testing platforms including improved memory and sensory-motor performance, and reduced depression/anxiety like behavior.

Below is a detailed analysis of our pre-clinical data.

ONP-002 Induction of PXR. The induction of the human CYP450 enzymes, CYP2B6, and CYP3A4 by ONP-002, as measured by mRNA expression, was tested in human hepatocytes from 3 donors at 3 concentrations: 1 μM, 10 μM and 100 μM. (Table 1). We show that ONP-002 through the known PXR-mechanism produced a modest induction of CYP3A4, up to 17% of the positive control, and a greater induction of CYP2B6, of up to 59% of the positive control, both at a concentration of 100 μM. Past data shows that ONP-001 (ent-Progesterone) and Progesterone induce the PXR receptor (1). Receptor binding studies have been performed showing neither ONP-001 or -002 activate the classical Progesterone Receptor.

| 4 |

Table 1

| Compound | Concentration μM | CYP2B6 Fold induction | % Of positive control | CYP3A4 Fold induction | % Of positive control | |||||||||

| Mean | SD | Mean | Mean | SD | Mean | |||||||||

| Rifampicin | 30 | - | - | - | 18 | 9.9 | 100 | |||||||

| Phenobarbital | 1000 | 5.1 | 2.9 | 100 | - | - | - | |||||||

| Omeprazole | 50 | - | - | - | - | - | - | |||||||

| Flumazenil (neg control) | 30 | 1.1 | 0.1 | 21 | 1.1 | 0.3 | 6 | |||||||

| ONP-002 | 1 | 1 | 0.2 | 19 | 1.3 | 0.3 | 7 | |||||||

| 10 | 1.6 | 0.6 | 31 | 2.4 | 0.6 | 13 | ||||||||

| 100 | 3.0 | 2.6 | 59 | 3.0 | 2.1 | 17 | ||||||||

ONP-002 Animal Studies. All surgical animals (male Sprague-Dawley rats approx. 250 grams) were anesthetized with an initial isoflurane induction for 4 min-the minimum time necessary to sedate the animal. The scalp was shaved and cleaned with isopropanol and betadine. During the stereotaxic surgery, anesthesia was maintained with isoflurane. A medial incision was made, and the scalp was pulled back over the medial frontal cortex. A 6-mm diameter craniotomy was performed exposing the brain tissue. An electrically controlled injury device using a 5 mm metal impactor was positioned over the exposed brain. An impact speed of 1.6 m/s at a 90-degree angle from vertical was used to produce an open head injury at a depth of 1mm to create a milder TBI. All treatments were given intranasal (IN) as a liquid solution with a micro atomizer. Vehicle for all administrations was 22.5% Hydroxy-Propyl-β-cyclodextrin (HPβCD).

Molecular Studies - Brain tissue was taken from the penumbral region of injury.

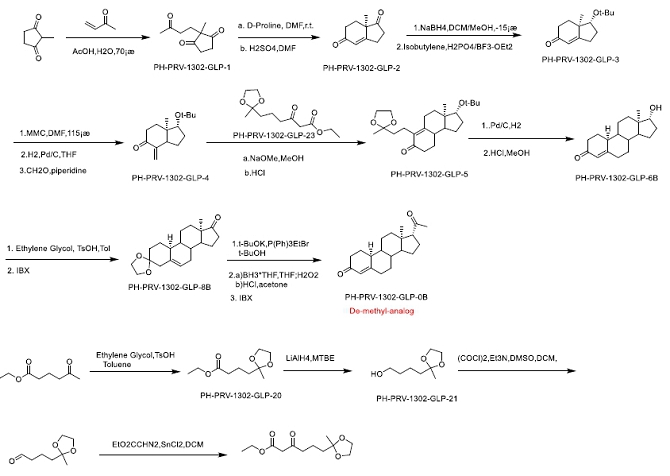

Figure 2

Cerebral Edema. In Figure 2, we show that ONP-002 reduces swelling in rats compared to vehicle-treated at 24-hrs after brain injury by measure of brain water content through speed-vacuum dehydration and tissue weight comparisons. ONP-002-treated (4mg/kg) and vehicle-treated were compared to sham which was set at zero. Local edema can occur after mTBI. Severe cerebral edema is associated with poor outcomes including increased mortality after mTBI with Second Impact Syndrome (2). *Denotes significance at p<0.05, n=6

| 5 |

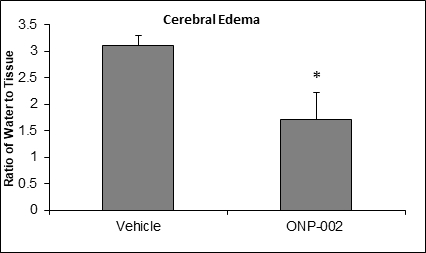

Figure 3

Inflammation. mTBI causes vascular and neuronal stress. Microglia and reactive astrocytes infiltrate the areas of injury and release inflammatory mediators, like TNF-alpha (3). In Figure 3, we show that ONP-002 (4mg/kg) reduces TNF-alpha-mediated neuroinflammation in brain tissue of rats compared to vehicle at 24-hrs after mTBI (ELISA). *denotes significance at p<0.05, n=6

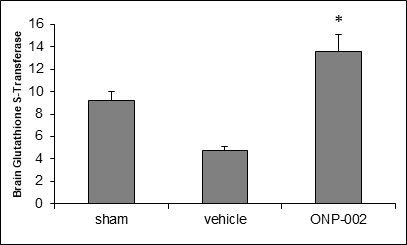

Figure 4

Oxidative Stress. Brain trauma causes Diffuse Axonal Injury (DAI) leading to elevated production of Reactive Oxygen Species (ROS), which causes neuronal damage (4). In Figure 4, we show that early treatment with ONP-002 (4mg/kg) improves antioxidant capacity in rats compared to vehicle-treated following mTBI by increasing protein expression of GST (ELISA) at 24hrs post-injury. *Denotes significance at p<0.05, n=6

| 6 |

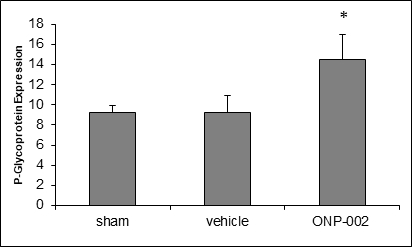

Figure 5

Autophagy. Brain trauma leads to neuronal damage with both intra and extracellular debris accumulation, which reduces cellular function and can lead to cell death (5). In Figure 5, we show that treatment with ONP-002 (4mg/kg) increases P-glycoprotein (PGP, ELISA), a molecule involved in macro-autophagy needed for intra and extracellular cleaning, in rats compared to vehicle-treated following mTBI at 24hr post-injury. *Denotes significance at p<0.05, n=6

Behavioral Studies

| 7 |

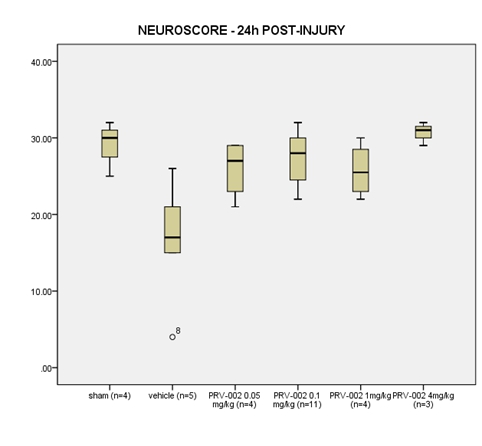

Neuroscore. In Figure 6, we show that treatment with ONP-002 (aka PRV-002) in rats enhances re-acquisition of motor skills by 24-hrs following mTBI when compared to vehicle-treated. Vestibular and visual motor dysfunction are hallmark signs of grade 3, severe mTBI where discoordination, dizziness and brain fog are seen and correlated to a greater incidence of Post-Concussion Syndrome (PCS) (6). A dose-response effect was seen with ONP-002 treatment at 4mg/kg producing the most desired effects. There were no statistical differences between ONP-002 treatments and sham. Data was analyzed using Kruskall-Wallis’s test to evaluate group differences. Pair-wise comparisons were carried out using the Mann-Whitney U Test. * denotes significance at p<0.05.

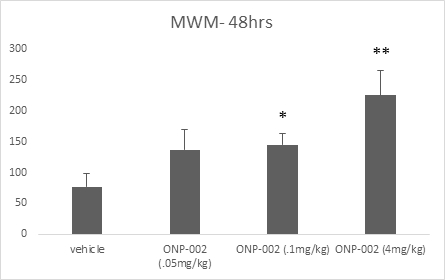

Figure 7

Short-Term Memory. Using the Morris Water Maze (MWM) method to assess shorter-term memory function we show in Figure 7 a dose-response effect at 48-hrs post-injury. ONP-002-treated rats had improved memory with significance seen between ONP-002 at 4mg/kg and vehicle-treated animals. Short-term memory deficits are often seen immediately following mTBI. Short-term memory impairment is a hallmark sign of PCS where deficits are seen for weeks or even longer (7). A one-way analysis of variance (ANOVA) was used to evaluate group differences in MWM memory score. Post-hoc analysis of pair-wise comparisons was carried out using Fisher’s Protected Least Significant Differences (PLSD) test. * denotes significance from vehicle at p<0,05, **denotes significance at p<0.005 from all groups. n=11

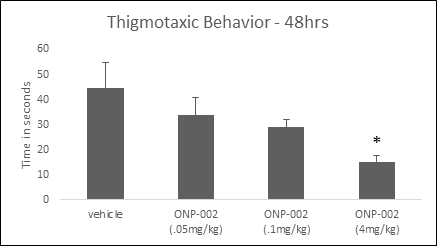

Figure 8

Thigmotaxic Behavior. Using the MWM tank to assess depression/anxiety-like behavior we show in Figure 8 a dose response effect on thigmotaxic behavior and that ONP-002 (4mg/kg)-treated rats had reduced thigmotaxis at 48-hrs post-injury compared to vehicle-treated. Depression and anxiety are commonly seen in patients diagnosed with PCS (8). ANOVA was used to evaluate group differences in thigmotaxis. * Denotes significance at p<0.005, n=8

| 8 |

Cell Culture Studies

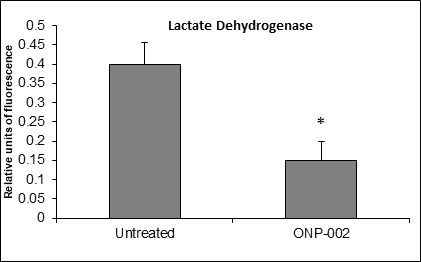

Figure 9

Neuronal Cell Viability. In a neuronal cell culture model (SH-SY5Y) of hypoxia-ischemia (oxygen-glucose deprivation (OGD), 24hrs), ONP-002 (5μM) reduces cell damage (Figure 9) as a measure of lactate dehydrogenase (membrane disruption) in cultured media. * Denotes significance at p<0.005

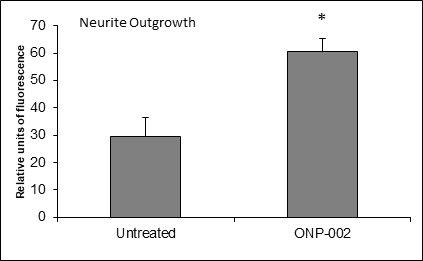

Figure 10

Neuronal Cell Recovery. Neurite outgrowth, indicative of cellular health and re-connectivity, was enhanced with the administration of ONP-002 (1μM) following exposure to hypoxia-ischemia (OGD) for 24hrs in a SH-SY5Y neurons compared to no treatment in cultured media.

| 9 |

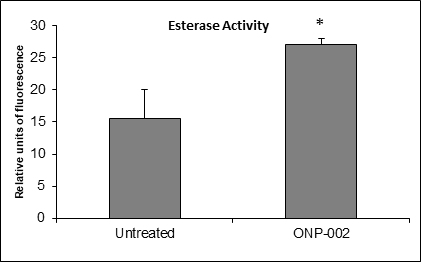

Figure 11

Neuronal Survival. Significant increases in esterase activity (Figure 11), a measure of cell viability, were observed in SH-SY5Y neurons treated with ONP-002 (1µM) following 24hrs of OGD in cultured media. * Indicates a significant difference from untreated OGD cells, p < 0.05.

Brain Biodistribution Studies. Table 2 below represents a comparison of ONP-002 levels in various parts of the brain, blood plasma and cerebrospinal fluid (CSF) in dogs (n=3) that were dosed intranasal (IN) 3 times; time 0, 4-hr and 8-hr. Dogs were sacrificed, and tissues were harvested at 30 minutes after the 8-hr final dose. Using a micro atomizer, dogs were given 23mg in each nostril dissolved in a 1ml of 22.5% HPβCD vehicle solution at each dosing interval for a total dose of 46 mg/dog per dosing interval. IN delivery increases direct drug flow into the brain in shorter periods of time through the peri axonal space of the olfactory nerves that innervate the superior chambers of the nasal cavity. The utility of IN dosing as a clinical route to achieve greater drug targeting of the brain and less systemic exposure was confirmed in this study whereby IN dosing of ONP-002 achieved up to 3.1-fold higher exposure in whole brain tissue (1888 ng/g) compared to systemic plasma (607 ng/ml). Further supporting the IN route of delivery these results show a total of 93% of the recovered drug was found in the brain. Only 5% of the drug was found in the circulating plasma and only 2% was found in the CSF. Comparable levels of ONP-002 were found throughout the brain at 30-min after the 8-hr treatment.

Table 2. Comparative exposure of ONP-002 in brain tissue, CSF and plasma following IN dosing in dogs

| Tissue | Subregion | Mean_ONP-002 concentration (ng/g brain) or (ng/ml CSF and plasma) |

Fold difference tissue exposure/plasma exposure | |||

| Brain tissue section | Frontal lobe | 2403 | 3.9 | |||

| Occipital lobe | 2332 | 3.8 | ||||

| Olfactory lobe | 2049 | 3.4 | ||||

| Parietal lobe | 2386 | 3.9 | ||||

| Temporal lobe | 2368 | 3.9 | ||||

| Whole brain | 1888 | 3.1 | ||||

| CSF | 33.2 | 0.05 | ||||

| Plasma | 607 | 1 | ||||

| 10 |

ONP-002 Toxicology and Safety Program

Early Work in Pharmacokinetics. ONP-002 was evaluated in IND-enabling studies to uncover any potential safety liabilities associated with this treatment. Initially, several dose-range studies were performed in rats to determine the maximum tolerated systemic dose and to compare relative exposure/tolerability following multiple routes of administration, including the route intended for human dosing which is IN. These studies were used to guide dosing for the pivotal (GLP) 14-day repeat dose toxicology studies in dogs. A single and 7-day repeat dose of 38.5 mg/kg was well tolerated in rats and deemed to be the maximum tolerated dose (MTD). The resulting ONP-002 plasma exposure in these animals was very high (Cmax 120863 ng/ml), which exceeded exposure following IN administration of ONP-002 at a dose of 4.6 mg/kg (63.8 ng/ml), just above the dose of 4 mg/kg at which maximum efficacy was observed in the rat TBI model. Absorption following IN dosing was more rapid, as was clearance, with minimal drug evident in plasma by 24-hrs post dose compared to IV.

Pharmacokinetics and Safety of IN ONP-002 in Dog. This pivotal GLP 14-day study used repeat dosing of ONP-002, 3X a day, approximately 4 hours apart, for 14 consecutive days at concentrations of 0, 3, 10 or 23 mg/mL at a volume of 1 mL/nostril to beagle dogs (both nostrils had drug administered). The IN treatment was given as a liquid solution using a micro atomizer using 22.5% HPβCD as the vehicle. IN ONP-002 dosing revealed that ONP-002 was well tolerated up to the highest dose of 23 mg/ml or 46mg in total per dosing. Clinical observations were limited to increased salivation in dogs which occurred in a dose-dependent manner. There were no effects on body weight, food consumption, ophthalmic parameters, clinical chemistry, haematology, or organ weights at any of the doses tested. Microscopic analysis revealed purulent exudates in the nasal turbinate and evidence of inflammatory infiltrates and fibrin deposition in the lungs. All of these events were classified as mild, reversed during the recovery period, and did not appear to show any dose dependency. Similar findings were evident in vehicle control treated dogs indicating the findings were vehicle related. The highest dose of 23 mg/ml was thus determined to be the NOAEL which is equivalent to a ONP-002 dose of 1.5mg/kg and 2.3mg/kg in male and female dogs, respectively. Table 3 shows the dose-dependent increase in plasma exposure of ONP-002 in male and female dogs following IN administration. Plasma exposure levels were similar in males and females and there did not appear to be any evidence of drug accumulation following multiple doses.

| Table 3 - Dogs | Mean systemic exposure parameters | |||||||||||||

| Males (15kg weight) | Females (10kg weight) | |||||||||||||

| IN ONP-002 Dose concentration (mg/ml) | 3 | 10 | 23 (1.5mg/kg) | 3 | 10 | 23 (2.3mg/kg) | ||||||||

| Cmax (ng/ml) | D1 | 103 | 225 | 751 | 61.8 | 468 | 744 | |||||||

| D14 | 85.7 | 235 | 591 | 82.3 | 408 | 681 | ||||||||

| AUC (ng*h/ml) | D1 | 1100 | 2470 | 7410 | 804 | 3400 | 8260 | |||||||

| D14 | 1090 | 3490 | 9140 | 1010 | 5250 | 10100 | ||||||||

Cardiopulmonary Safety Pharmacology. The effect of ONP-002 on the human ether-a-go-go related gene (hERG) tail currents was assessed in a non-Good Laboratory Practice (GLP) study using manual whole-cell patch clamp (Table 4). ONP-002 tested at a single concentration of 10 μM inhibited hERG tail currents by 42.6% (n=3). In order to achieve a safety factor of 30-fold between in vitro hERG IC50 and free plasma levels of ONP-002 in clinical studies, Cmax should not exceed a free drug concentration of 0.33 μM (99 ng/ml). ONP-002 is 97.2% human plasma protein bound and is estimated to reach a plasma Cmax of 12.5 nM, the highest dose of 0.533 mg/kg to be administered in the planned first in human (FIH) study, which provides a safety factor of 800-fold. A GLP study is planned at Charles River, Inc. and will be performed prior to IND submission.

| 11 |

Table 4. Inhibition of hERG tail currents by ONP-002

| Compound ID | Client compound ID |

Batch # | Concentration (μM) | % Inhibition | Mean | |||||||||

| N1 | N2 | N3 | ||||||||||||

| US034-0012558-1 | ONP-002 | 4 | 10 | 36.58 | 37.25 | 53.85 | 42.56 | |||||||

Positive reference control |

Cisapride | 1 | 96.99 | - | - | 96.99 | ||||||||

ONP-002 did not exert any effects on cardiac safety parameters evaluated by telemetry in male and female dogs as part of a 14-day repeat dose GLP toxicology study. Intranasal doses of 3, 10 and 23 mg/ml ONP-002 administered 3 times daily for 14 days did not have any significant effects on heart rate, pulse rate (PR), QRS and QT/QTc intervals or respiratory rate (RR) interval when compared to pre-dose values and vehicle control animals. An atrial depolarization was noted pre-dose in 1 animal which is occasionally observed in dogs and was not considered to be related to test article. The NOAEL for cardiac related effects in dogs was thus determined to be ≤ 23 mg/ml (equivalent to 4.8 mg/kg in male dogs and 7.2 mg/kg in female dogs). ONP-002 was also evaluated for potential central nervous system (CNS) toxicity in rats using a standard functional observational battery that was included as part of the 14-day repeat dose GLP toxicology study. IN administration of ONP-002 at 3, 10 and 23 mg/ml 3 times daily for 14 days was well tolerated with excess salivation and nares staining being the only observations occurring in 2 rats (one female in the 10 mg/ml group and 1 male in the 23 mg/ml group). Both incidences were not evident by the end of the 14-day recovery period.

As the intended clinical route of administration of ONP-002 is IN, the effects of ONP-002 on respiratory function were evaluated in a stand-alone GLP safety pharmacology study in male rats using whole-body plethysmography. ONP-002 administered as a single IN dose of 0.04, 0.4 or 4 mg/kg had no significant effect on respiratory rate, tidal volume (TV) or minute volume (MV) compared to vehicle treated animals and pre-dose values. In addition, there were no observations of respiratory distress following IN dosing of ONP-002 in repeat-dose GLP toxicology studies in rats and dogs. Tachypnea was however, observed in a dose range finding and 7-day repeat dose study in rats following intravenous (IV) administration of ONP-002, where systemic exposure of ONP-002 was almost 300-fold higher that that reached by the IN route.

Absorption, Distribution and Metabolism. Caco-2 permeability which was used as a surrogate for potential BBB permeability, was high with little evidence of PGP or breast cancer resistant protein mediated efflux. Cytochrome P450 mediated metabolism of ONP-002 is predominantly via CYP3A4. No significant inhibition, including time-dependent inhibition, was observed against major cytochrome P450 isoforms when ONP-002 was tested at a single concentration of 10 μM. There was some evidence of CYP2D6 and CYP3A4 induction (up to 3-fold) at a ONP-002 concentration of 100 μM. ONP-002 (10 μM) also exhibited minimal activity against a panel of major solute carriers and ATP-binding cassette (ABC) transporters, with inhibition of organic cation transporter 2 (OCT2) (89%) being the only result of note.

Genotoxicity. ONP-002 did not exhibit mutagenic activity in the bacterial AMES test or clastogenic activity in the mammalian in vitro micronucleus assay up to a maximum concentration of 100 μM. We have scheduled the In Vivo Micronucleus testing which is required for an IND with the FDA. We expect it will be completed by the end of Q3 2024.

Summary

| ● | The drug has completed toxicology studies in rats and dogs. Studies show that ONP-002 has a safety margin over 90X its predicted efficacious dose. | |

| ● | In preclinical animal studies, the asset demonstrated rapid and broad biodistribution throughout the brain while simultaneously reducing swelling, inflammation, and oxidative stress. | |

| ● | We believe ONP-002 has an equivalent, and potentially superior, neuroprotective effect compared to related neurosteroids. | |

| ● | Animals treated with the ONP-002 post-concussion showed positive behavioral outcomes using various testing platforms including improved memory and sensory-motor performance, and reduced depression/anxiety like behavior. |

| 12 |

ONP-002 Clinical Trials

ONP-002 has completed a Phase 1 clinical trial in healthy human subjects showing it is safe and well tolerated.

Safety studies have established a dosing regimen of 2X/day for fourteen days. The Phase I clinical trial was performed in Melbourne, Australia with a Contract Research Organization (CRO), Avance Clinical Pty Ltd and Nucleus Network Pty Ltd. The country of Australia provides a greater than 26% currency exchange advantage and a 43.5% rebate at the end of our fiscal year from the Australian government on all Research and Development performed in Australia. A comprehensive Investigator’s Brochure was created and approved by the Alfred Ethics Committee in Australia.

The Phase 1 study was double-blinded, randomized and placebo controlled (3:1, drug:placebo). Phase 1 used a Single Ascending/Multiple Ascending (SAD/MAD) drug administration design. The SAD component was a 1X treatment (low, medium, or high dose) and the MAD component was a 1X/day treatment for five consecutive days (low and medium dose). Blood and urine samples were collected at multiple time points for safety pharmacokinetics. Standard safety monitoring was provided for each body system.

Forty human subjects (31 males, 9 females) were successfully enrolled in Phase I. The Safety Review Board, made up of medical doctors, has reviewed the trial data and has determined the drug is safe and well tolerated at all dosing levels.

Oragenics anticipates preparing for Phase 2 clinical trials to further evaluate ONP-002’s safety and efficacy. Based on the Phase I data, we plan to apply for an Investigational New Drug application with the FDA and conduct a Phase II trial in the United States.

We anticipate a Phase 2 clinical trial will be performed administering ONP-002 intranasally in concussed patients 2x a day for up to fourteen days. The Phase 2a feasibility study will be performed in AUS with a target initiation date in the second quarter of 2024 to be followed closely by a Phase 2b proof of concept study in the US following IND approval in the fourth quarter of 2024.

Planned Phase 2a Feasibility study

| ● | n (40) – 20 patients per arm. | |

| ● | Two arms – Low dose or placebo/High dose or placebo. | |

| ● | Evaluating enrollment methods, safety and pharmacokinetics in concussed patients |

Planned Phase 2b Proof of concept (POC) with Early Efficacy

| ● | n (120) – 60 patients per arm. | |

| ● | One arm receives placebo – One arm receives highest safe dose from feasibility study. | |

| ● | POC measurements; blood biomarkers, neurocognitive and visual-vestibular measures, symptom severity and incidence of developing Post-Concussion Syndrome (PCS), time to return to normal activities. |

Product Candidates

| Product/Candidate | Description | Status | ||

| ONP-002 | Intranasal drug for the treatment of moderate-to-severe concussion in the acute through subacute phases (mTBI) | Completed Phase I | ||

| ONP-001(*) | Neurosteroid being developed for the treatment of Niemann Pick Type-C Disease (NPC) | Pre-clinical | ||

| NT-CoV2-1 | Intranasal vaccine candidate (plasmid + adjuvant) to provide long lasting immunity against SARS-CoV-2 | Pre-clinical | ||

| Antibiotics | For the treatment of healthcare-associated infections. Semi-synthetic analogs of MU1140: Member of lantibiotic class of antibiotics. | Pre-clinical – Inactive |

* We currently own only 50% of the intellectual property related to ONP-001. The other 50% is owned by a third party. We anticipate this product candidate will be developed through a joint venture with a third party. However, the joint venture with that third party has not been finalized.

| 13 |

RISK FACTORS

Risk Related to Purchase of Neurology Assets from Odyssey

We may have difficulty raising additional capital, which could deprive us of the resources necessary to implement our business plan, which would adversely affect our business, results of operation and financial condition.

We need to raise additional capital to fund the development and commercialization of our product candidates and to operate our business, including ONP-002. The need to raise additional capital is expected to increase as a result of our purchase or the Neurology Assets. Part of the purchase price we paid Odyssey is $1,000,000 in cash. Additionally, we expect our operating expenses to increase, both due to additional employment costs and operating costs required to pursue the development of the Neurology Assets. In order to support the initiatives envisioned in our business plan, we will need to raise additional funds through the sale of assets, public or private debt or equity financing, collaborative relationships or other arrangements. If our operations expand faster or at a higher rate than currently anticipated, we may require additional capital sooner than we expect. We are unable to provide any assurance or guarantee that additional capital will be available when needed by our company or that such capital will be available under terms acceptable to our company or on a timely basis.

Our ability to raise additional financing depends on many factors beyond our control, including the state of capital markets, the market price of our common stock and the development or prospects for development of competitive products by others. If additional funds are raised through the issuance of equity, convertible debt or similar securities of our company, the percentage of ownership of our company by our company’s stockholders will be reduced, our company’s stockholders may experience additional dilution upon conversion, and such securities may have rights or preferences senior to those of our common stock. The preferential rights granted to the providers of such additional financing may include preferential rights to payments of dividends, super voting rights, a liquidation preference, protective provisions preventing certain corporate actions without the consent of the fund providers, or a combination thereof. We are unable to provide any assurance that additional financing will be available on terms favorable to us or at all.

If adequate funds are not available or are not available on acceptable terms, our ability to take advantage of the Neurology Assets acquired from Odyssey will be limited significantly. With limited capital, we expect to continue to scale back or delay implementation of research and development of our Covid programs and to put our lantibiotics on hold, and we may choose instead to focus the limited capital on the concussion asset purchased from Odyssey. Thus, the unavailability of capital could substantially harm our business, results of operations and financial condition.

Our success with regard to the Neurology Assets depends on the viability of our business strategy with regard to those assets, which is unproven and may be unfeasible.

Our revenue and income potential with regard to the Neurology Assets, in particular the concussion asset, are unproven, and we continue to develop our strategy for such assets. Our anticipated business model is based on a variety of assumptions based on a growing trend in the healthcare systems in the United States and many other countries. These assumptions may not reflect the business and market conditions we actually face. As a result, our operating results could differ materially from those projected under our business model, and our business model may prove to be unprofitable. The product candidate ONP-002 (the concussion asset) being developed is in its early stages and will require extensive testing and clinical trials before it is commercialized. There is no guarantee that ONP-002 will be approved for commercial use. The product candidate ONP-001 (the potential treatment for Niemann Pick Disease Type C) is in its early stages and will require extensive testing and clinical trials before it is commercialized. There is no guarantee that ONP-001 will be approved for commercial use. Further, we own 50% of the the rights to this product candidate, with the other 50% owner by a third party. We anticipate this product candidate will be developed through a joint venture with a third party. However, the joint venture with that third party has not been finalized. If we fail to obtain marketing authorization for these product candidates, our business, financial condition, and results of operations will be materially adversely affected.

| 14 |

There are substantial inherent risks in attempting to commercialize newly developed products, and, as a result, we may not be able to successfully develop the new products acquired from Odyssey.

We hope to conduct research and development of the purchased Neurology Assets. However, commercial feasibility and acceptance of such product candidates are unknown. Scientific research and development require significant amounts of capital and takes an extremely long time to reach commercial viability, if at all. During the research and development process, we may experience technological barriers that we may be unable to overcome. Because of these uncertainties, it is possible that some or all of our future product candidates will never be successfully developed. If we are unable to successfully develop new products, we may be unable to generate new revenue sources or build a sustainable or profitable business. Additionally, as a result of the Odyssey transaction, since we operate with limited resources and staff, our attention and resources will be diverted away from our existing lantibiotic and Covid programs, resulting in further delays in the development and commercialization of such programs.

We will need to achieve commercial acceptance of our products, if cleared or approved, to generate revenues and achieve profitability.

Superior products may be introduced that compete with the Neurology Assets, which would diminish or extinguish the uses for the products candidates acquired from Odyssey, if cleared or approved. We cannot predict when significant commercial market acceptance for such products, if cleared or approved, will develop, if at all, and we cannot reliably estimate the projected size of any such potential market. If markets fail to accept such products, then we may not be able to generate revenue from them. Our revenue growth and achievement of profitability will depend substantially on our ability to introduce new products that are accepted by customers. Our competitors in the industry are predominantly large companies with longer operating histories, with significantly easier access to capital and other resources and an established product pipeline than us. There can be no assurance that we will be able to establish ourselves in our targeted markets, or, if established, that we will be able to maintain our market position, if any. Our commercial opportunity may be reduced if our competitors develop new or improved products that are more convenient, more effective or less expensive than our product candidates are. Competitors also may obtain FDA or other regulatory marketing authorization for their products more rapidly or earlier than we may obtain marketing authorization for ours, which could result in our competitors establishing a strong market position before we are able to enter the market. If we are unable to cost-effectively achieve acceptance of our products by customers, or if our products do not achieve wide market acceptance, then our business will be materially and adversely affected.

The products candidates included in the Neurology Assets are still in development and we have not obtained authorization from any regulatory agency to commercially distribute such products in any country and we may never obtain such authorizations.

We currently have no products authorized for commercial distribution in either the United States, Europe or any other country. Similarly, the products candidates we acquired from Odyssey are still in development. Like the product candidates we are developing, the Neurology Assets require regulatory clearance or approvals. We cannot begin marketing and selling product candidates until we obtain applicable authorizations from the applicable regulatory agencies. The process of obtaining regulatory authorization is expensive and time-consuming and can vary substantially based upon, among other things, the type, complexity and novelty of a product candidate. Changes in regulatory policy, changes in or the enactment of additional statutes or regulations, or changes in regulatory review for each submitted product application may cause delays in the authorization of a product candidate or rejection of a regulatory application altogether.

The FDA has substantial discretion in the review process and may refuse to accept our application or may decide that data are insufficient to grant the request and require additional pre-clinical, clinical, or other studies. In addition, varying interpretations of the data obtained from pre-clinical and clinical testing could delay, limit, or prevent marketing authorization from the FDA or other regulatory authorities. Any marketing authorization from the FDA we ultimately obtain may be limited or subject to restrictions or post-market commitments that render the product candidate not commercially viable. If our attempts to obtain marketing authorization are unsuccessful, we may be unable to generate sufficient revenue to sustain and grow our business, and our business, financial condition, and results of operations will be materially adversely affected.

| 15 |

We are, and will continue to be, dependent in significant part on outside scientists and third-party research institutions for our research and development in order to be able to commercialize our product candidates.

We currently have a limited number of employees and resources available to perform the research and development necessary to commercialize our product candidates and potential future product candidates. We therefore rely, and will continue to rely, on third-party research institutions, collaborators and consultants for this capability. While the Company continues to seek additional funding, it is taking steps to reduce the use of its cash resources, which include the determination to terminate the Lease.

We are heavily dependent upon the ability and expertise of our management team and a very limited number of employees and the loss of such individuals could have a material adverse effect on our business, operating results or financial condition.

We currently have a very small management team. Our success is dependent upon the ability, expertise and judgment of our senior management. While employment agreements are customarily used as a primary method of retaining the services of key employees, these agreements cannot assure the continued services of such employees. Any loss of the services of such individuals could have a material adverse effect on our business, operating results or financial condition.

We believe that our future success with regard to the Neurology Assets will depend significantly on the skills and efforts of Joseph Michael Redmond, our new President, and other key personnel, including Jacob VanLandingham, Ph.D., one of the Company’s independent contractors. The loss of the services of any of these individuals could harm our ability to successfully pursue the development of the Neurology Assets. If any of our executive officers or key personnel left or was otherwise unable to work and we were unable to find a qualified replacement and/or to obtain adequate compensation for such loss, we may be unable to manage our business, which could harm our operating results and financial condition.

Mr. Redmond continues to serve as President and CEO of Odyssey, which may give rise to conflicts of interest, including with regard to the transaction between the Company and Odyssey related to the Neurology Assets. Additionally, while we expect Mr. Redmond to devote substantially all of his business time and efforts to the Company, we can make no assurance of this given his continuing role with Odyssey.

Prevacus, Inc., is the Company from whom Odyssey purchased the Neurology Assets in 2021. On December 5, 2022, the Mississippi Department of Human Services (“MDHS”) filed an Amended Complaint in the Circuit Court of Hinds County, Mississippi First Judicial District against Mississippi Community Education Center, Inc., a non-profit corporation, Nancy New, its director, Prevacus, Dr. VanLandingham its founder , and several other defendants, alleging, among other things, a conspiracy to defraud the MDHS. The MDHS is designated by Mississippi law as the State agency exclusively responsible for administering the federally-authorized and federally-funded anti-poverty (or “welfare”) program known as the Temporary Assistance for Needy Families program, or “TANF.” With regard to Prevacus and Dr. VanLandingham, the complaint alleges that $2.1 million was funneled through the Mississippi Community Education Center, a nonprofit run by Nancy New, to Prevacus and PresolMD, another company founded by Dr. VanLandingham. The MDHS, among other things, is seeking to recover $2.1 million it alleges went to Prevacus and PresolMD. Prevacus and Dr. VanLandingham have denied any wrongdoing and have denied being aware that the funds received from Community Education Center, Inc. were TANF funds. When Odyssey agreed to purchase the Prevacus assets, it did not agree to assume any liability for refunding MDHS. Similarly, any such liabilities would be deemed excluded liabilities under the Company’s asset purchase agreement with Odyssey. As such, the Company does not believe it has any financial exposure related to the reimbursement of the funds paid to Prevacus and does not believe there are any grounds on which the Company could become embroiled in the foregoing legal proceedings. Dr. VanLandinham is not an Officer or Director of Oragenics, but is instead an independent contractor. Nevertheless, any negative media related to foregoing legal proceedings, and in particular any negative media related to the concussion assets or Dr. VanLandingham, may negatively impact the Company’s ability to raise capital and otherwise continue the development of the Neurology Assets. Furthermore, Dr. VanLandingham’s ability to continue to assist in the development of the Neurology Assets may be negatively impacted by his need to respond to, and participate in, the foregoing legal proceedings.

| 16 |

As a result of the purchase of the Neurology Assets, we anticipate growth in our business and increased costs, and any inability to manage such growth could harm our business.

Our success will depend, in part, on our ability to effectively manage our growth and expansion. Any growth in, or expansion of, our business is likely to continue to place a significant strain on our management and administrative resources, infrastructure and systems. In order to succeed, we will need to continue to implement management information systems and improve our operating, administrative, financial and accounting systems and controls. We will also need to train new employees and maintain close coordination among our executive, accounting, finance and operations organizations. These processes are time-consuming and expensive, will increase management responsibilities and will divert management attention. Our inability or failure to manage our growth and expansion effectively could substantially harm our business and adversely affect our operating results and financial condition.

The third party upon whom we rely for the supply of ONP-002 is our sole source of supply, and the loss of this supplier could significantly harm our business.

ONP-002 is a fully synthetic, non-naturally occurring neurosteroid. Pharmaron, Inc. is our current partner in the development of synthetic chemistry and manufacturing of the ONP-002 (Molecular Formula: C20H28O2, Molecular Weight: 300.14 g/mol). Our ability to successfully develop our ONP-002 product candidates, and to ultimately supply our commercial products in quantities sufficient to meet the market demand, depends in part on our ability to obtain the drug product and drug substance for our product candidates in accordance with regulatory requirements and in sufficient quantities for commercialization and clinical testing. We do not currently have arrangements in place for a redundant or second-source supply of any products or substances in the event our current supplier ceases their operations or stops offering us sufficient quantities of these materials for any reason.

We are not certain that our single-source supplier will be able to meet our demand, either because of the nature of our agreement with the supplier, our limited experience with the supplier or our relative importance as a customer to the supplier. It may be difficult for us to assess its ability to timely meet our demand in the future based on past performance. While our supplier has generally met our demand on a timely basis in the past, they may subordinate our needs in the future to their other customers.

Moreover, if there is a disruption to our third-party manufacturers’ or suppliers’ relevant operations the supply of ONP-002 and its components will be delayed until such manufacturer or supplier restores the affected facilities or we or they procure alternative manufacturing facilities or sources of supply. Our ability to progress our pre-clinical and clinical programs could be materially and adversely impacted if any of the third-party suppliers upon which we rely were to experience a significant business challenge, disruption or failure due to issues such as financial difficulties or bankruptcy, issues relating to other customers such as regulatory or quality compliance issues, or other financial, legal, regulatory or reputational issues. Additionally, any damage to or destruction of our third-party manufacturers’ or suppliers’ facilities or equipment may significantly impair our ability to manufacture our product candidates on a timely basis.

Establishing additional or replacement suppliers for drug product and drug substance used in our product candidates, if required, may not be accomplished quickly and can take several years, if at all. Furthermore, despite our efforts, we may be unable to procure a replacement supplier or do so on commercially reasonable terms, which could have a material adverse impact upon our business. If we are able to find a replacement supplier, such replacement supplier would need to be qualified and may require additional regulatory approval, which could result in further delay. While we seek to maintain adequate inventory of the drug product and drug substance used in our product candidates, any interruption or delay in the supply of components or materials, or our inability to obtain such drug product and drug substance from alternate sources at acceptable prices in a timely manner could impede, delay, limit or prevent our development efforts, which could harm our business, results of operations, financial condition and prospects.

| 17 |

Certain of the raw materials required in the manufacture and the formulation of our product candidates are derived from biological sources. Such raw materials are difficult to procure and may be subject to contamination or recall. Access to and supply of sufficient quantities of raw materials which meet the technical specifications for the production process is challenging, and often limited to single-source suppliers. Finding an alternative supplier could take a significant amount of time and involve significant expense due to the nature of the products and the need to obtain regulatory approvals. If we or our manufacturers are unable to purchase the raw materials necessary for the manufacture of our product candidates on acceptable terms in a timely manner, at sufficient quality levels, or in adequate quantities, if at all, our ability to produce sufficient quantities of our products for clinical or commercial requirements would be negatively impacted. A material shortage, contamination, recall or restriction on the use of certain biologically derived substances or any raw material used in the manufacture of our products could adversely impact or disrupt manufacturing, which would impair our ability to generate revenues from the sale of such product candidates, if approved or cleared.

If Odyssey were to convert all of its Series F Convertible Preferred Stock, they would own more than a majority of our outstanding shares of common stock.

At the closing of the Odyssey transaction, we issued 8,000,000 shares of Series F Convertible Preferred Stock to Odyssey, which are convertible into our common stock on a one-for-one basis. The Series F Convertible Preferred Stock is non-voting, but if Odyssey were to convert all of its shares of Series F Convertible Preferred Stock into our common stock, they would control the vote of more than a majority of our outstanding common stock. Such a conversion would likely be considered a change of control under the rules of the NYSE American, requiring us to apply for and meet the NYSE Americans initial listing standards. We do not currently meet those standards. Accordingly, our Certificate of Designation creating the Series F Preferred Stock specifies that the remainder of the Series F Convertible Preferred shares are not convertible until the occurrence of all of the following: (i) Oragenics’ shall have applied for and been approved for initial listing on the NYSE American or another national securities exchange or shall have been delisted from the NYSE American, which Oragenics’ does not anticipate undertaking until it meets the NYSE American’s initial listing standards, and (ii) if required by the rules of the NYSE American, Oragenics’ shareholders shall have approved any change of control that could be deemed to occur upon the conversion of the Series F Preferred Stock into common stock, based on the fact and circumstances existing at such time.

Risks Related To Our Financial Condition and Need For Additional Capital

We have incurred significant losses since our inception and expect to continue to experience losses for the foreseeable future.

We have incurred significant net losses and negative cash flow in each year since our inception, including net losses of approximately and $7.9 million and $12.1 million for the nine months ended September 30, 2023 and September 30, 2022, respectively, and approximately $14.2 million and $15.7 million for the years ended December 31, 2022, and 2021, respectively. As of September 30, 2023, our accumulated deficit was approximately $193.5 million. We have devoted a significant amount of our financial resources to research and development, including our nonclinical development activities and clinical trials. Additionally, in connection with the purchase of the Neurology Assets, we paid Odyssey $1.0 million. We expect that the costs associated with our plans to begin Phase 2 work on ONP-002 and our preclinical research for our NT-CoV2-1 vaccine product candidate, as well as any research and development of our Covid product candidate. Additionally, our License Agreements also require the payment of certain recurring and performance-based royalties that may negatively impact our financial capabilities. As a result, we expect to continue to incur substantial net losses and negative cash flow for the foreseeable future. These losses and negative cash flows have had, and will continue to have, an adverse effect on our shareholders’ equity and working capital. Because of the numerous risks and uncertainties associated with product development and commercialization, we are unable to accurately predict the timing or amount of substantial expenses or when, or if, we will be able to generate the revenue necessary to achieve or maintain profitability.

We will need to raise additional capital in the future to complete the development and commercialization of our product candidates and operate our business.

Developing and commercializing biopharmaceutical products, including Phase 2 work for our ONP-002 product candidate and conducting nonclinical studies and clinical trials and establishing manufacturing capabilities, and the progress of our efforts to develop and commercialize our product candidates, is expensive, and can cause us to use our limited, available capital resources faster than we currently anticipate. We anticipate that our estimated cash resources of approximately $3.5 million as of December 31, 2023, will be sufficient to fund our operations as presently structured through the second quarter of 2024. We are currently evaluating cost-saving initiatives, including restructuring that could allow further cash runway through 2024 to the extent such initiatives are undertaken. Our auditor has previously expressed substantial doubt about our ability to continue as a going concern and absent additional financing we may be unable to remain a going concern. Our actual costs may ultimately vary from our current expectations, which could materially impact our use of capital and our forecast of the period of time through which our financial resources will be adequate to support our operations. Our current cash, cash equivalents and short-term investments are not sufficient to fully implement our business strategy and sustain our operations. Accordingly, we will need to seek additional sources of financing and such additional financing may not be available on favorable terms, if at all. Until we can generate a sufficient amount of product revenue, if ever, we expect to finance future cash needs through public or private equity offerings, debt financings or corporate or government collaboration and licensing arrangements. If we do not succeed in raising additional funds on acceptable terms, we may be unable to complete existing nonclinical and planned clinical trials or obtain approval of our product candidates from the FDA and other regulatory authorities. We expect capital outlays and operating expenditures to increase over the next several years as we expand our infrastructure, and research and development activities. Specifically, we need to raise additional capital to, among other things:

| ● | conduct Phase 2 clinical trials for our ONP-002 product candidate; | |

| ● | conduct preclinical research for our NT-CoV-2-1 vaccine product candidate, file an IND with the FDA and, if approved, engage in Phase 1 clinical trials; |

| 18 |

| ● | engage in GMP and non-GMP manufacturing for our product candidates at the preclinical research and clinical trial stages; | |

| ● | fund our clinical validation study activities; | |

| ● | expand our research and development activities; and | |

| ● | finance our capital expenditures and general and administrative expenses. |

Our present and future funding requirements will depend on many factors, including:

| ● | the level of research and development investment budgeted to develop our current and future product candidates through each phase of development; | |

| ● | the timing, scope, progress, results and cost of research and development, testing, screening, manufacturing, preclinical and non-clinical studies and clinical trials, including any impacts related to the COVID-19 pandemic; | |

| ● | costs of filing, prosecuting, defending and enforcing patent claims and other intellectual property rights; | |

| ● | our need or decision to acquire or license complementary technologies or acquire complementary businesses; | |

| ● | changes in test development plans needed to address any difficulties in product candidate selection for commercialization; | |

| ● | competing neurological, vaccine and technological and market developments; | |

| ● | our interaction and relationship with the FDA, or other, regulatory agencies; and | |

| ● | changes in regulatory policies or laws that affect our operations. |

Additional capital may not be available on satisfactory terms, or at all. Furthermore, if we raise additional funds by issuing equity securities, dilution to our existing stockholders could result. Any equity securities issued also may provide for rights, preferences or privileges senior to those of holders of our common and preferred stock. If we raise additional funds by issuing debt securities, these debt securities would have rights, preferences and privileges senior to those of holders of our common stock, and the terms of the debt securities issued could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our technologies or our products under development or grant licenses on terms that are not favorable to us, which could lower the economic value of those programs to us. If adequate funds are not available, we may have to scale back our operations or limit our research and development activities, which may cause us to grow at a slower pace, or not at all, and our business could be adversely affected.

In addition, we could be forced to discontinue product development and commercialization of one or more of our product candidates, curtail or forego sales and marketing efforts, and/or forego licensing attractive business opportunities.

| 19 |

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements that are made pursuant to the safe harbor provisions within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation statements regarding our ability to timely and successfully achieve the anticipated benefits of acquiring certain assets from Odyssey Health, Inc. and our future performance, business prospects, events and product development plans. These forward-looking statements are based on management’s beliefs and assumptions and information currently available. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project” and similar expressions that do not relate solely to historical matters identify forward-looking statements. You should be cautious in relying on forward-looking statements because they are subject to a variety of risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed in any such forward-looking statements. These factors include, but are not limited to: the Risk Factors set forth in this Current Report on Form 8-K; our ability to advance the development of our product candidates, including the neurology assets acquired from Odyssey, under the timelines and in accord with the milestones we project; our ability to raise capital and obtain funding, non-dilutive or otherwise, for the development of our product candidates; the regulatory application process, research and development stages, and future clinical data and analysis relating to our product candidates, including any meetings, decisions by regulatory authorities, such as the FDA and investigational review boards, whether favorable or unfavorable; our ability to obtain, maintain and enforce necessary patent and other intellectual property protection; the nature of competition and development relating to concussion treatments; our expectations as to the outcome of preclinical studies and clinical trials and the potential benefits, activity, effectiveness and safety of our product candidates including as to administration, transmission, manufacturing, storage and distribution; potential adverse impacts due to the global COVID-19 pandemic, such as delays in regulatory review, interruptions to manufacturers and supply chains, adverse impacts on healthcare systems and disruption of the global economy; and general economic and market conditions and risks, as well as other uncertainties described in our filings with the U.S. Securities and Exchange Commission. All information set forth is as of the date hereof unless otherwise indicated. You should consider these factors in evaluating the forward-looking statements included and not place undue reliance on such statements. We do not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by law.

Item 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| Exhibit No. | Description | |

| 104 | Cover page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

| 20 |

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on this 16th day of January, 2024.

| ORAGENICS, INC. | ||

| (Registrant) | ||

| BY: | /s/ Janet Huffman | |

| Janet Huffman | ||

| Chief Financial Officer | ||

| 21 |